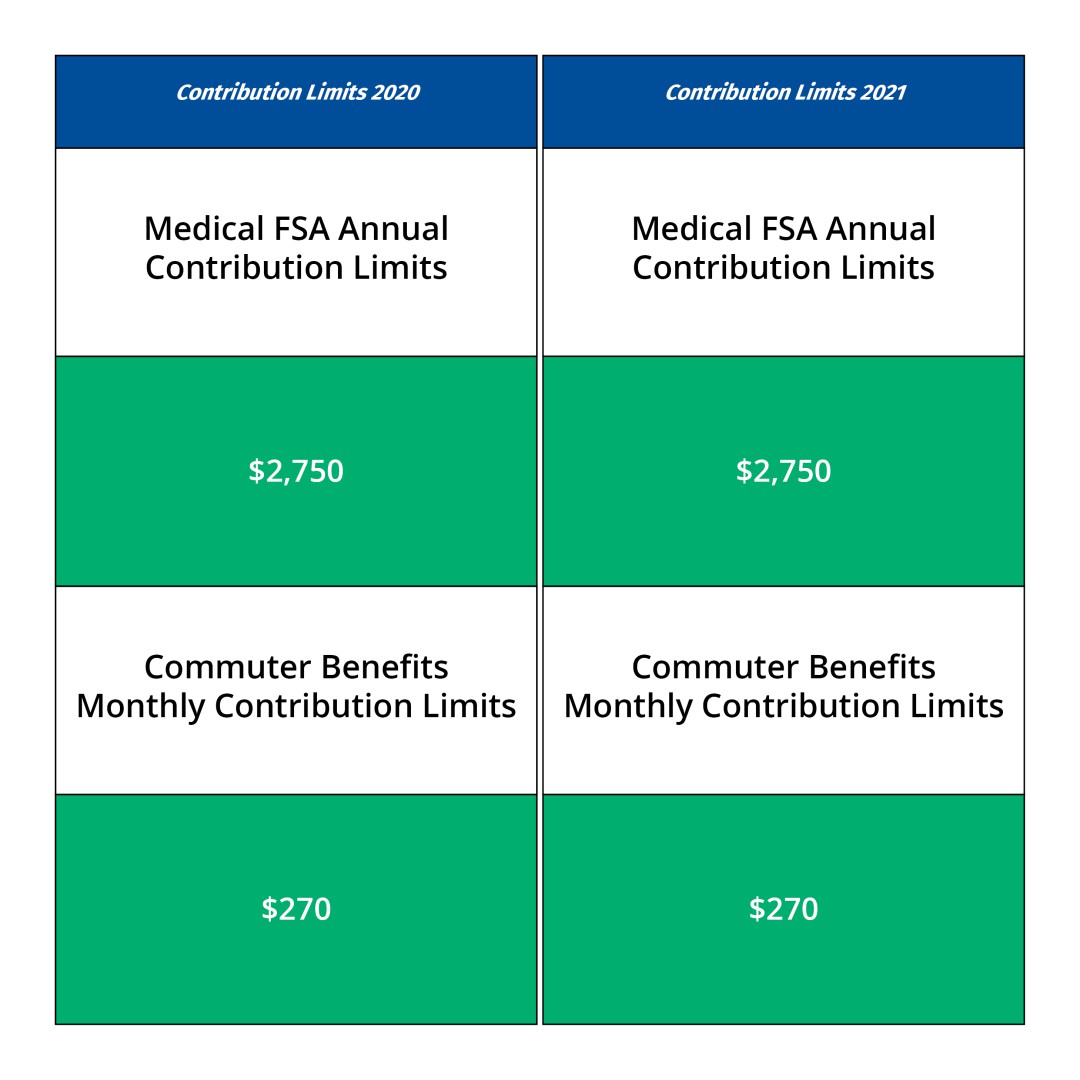

On October 27, 2020, the IRS released the 2021 FSA and Commuter Benefits maximum contribution limits.

There are no changes to flexible spending account (FSA) and commuter benefits contribution limits for 2021.

For health FSA plans that permit the carryover of unused amounts, the maximum carryover amount for 2021 is $550, an increase of $50 from the original 2020 carryover limit.

Cilck here for the IRS Release - Rev. Proc. 2020-45.

2021 HSA contribution limits were announced earlier this year.

If you have any questions, contact Surency at 800-264-9462.